Ichimoku Cloud Analysis 26.03.2024 (GBPUSD, USDCHF, NZDUSD)

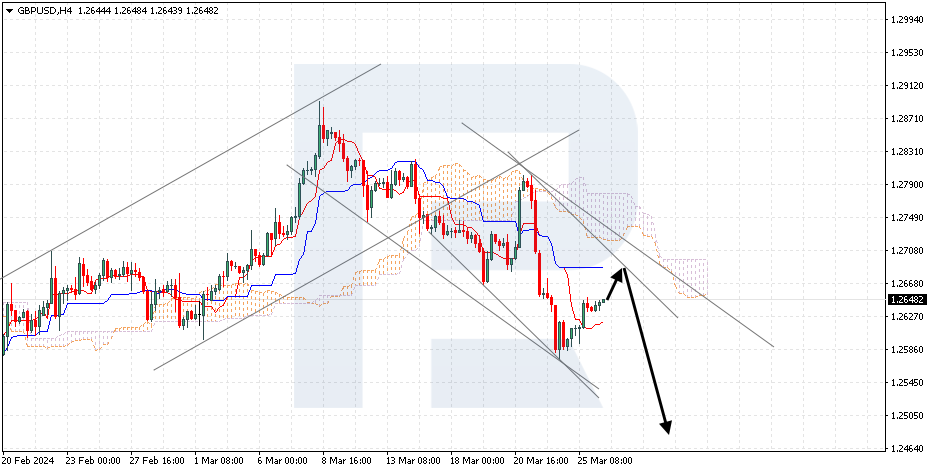

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD is rising after a rebound from the support. The instrument is going below the Ichimoku Cloud, which suggests a bearish trend. A test of the Kijun-Sen line at 1.2670 is expected, followed by a decline to 1.2485. An additional signal confirming the decline will be a rebound from the upper boundary of the bearish channel. The scenario can be cancelled by a breakout of the upper boundary of the Cloud with the price securing above 1.2795, which will mean further growth to 1.2885.

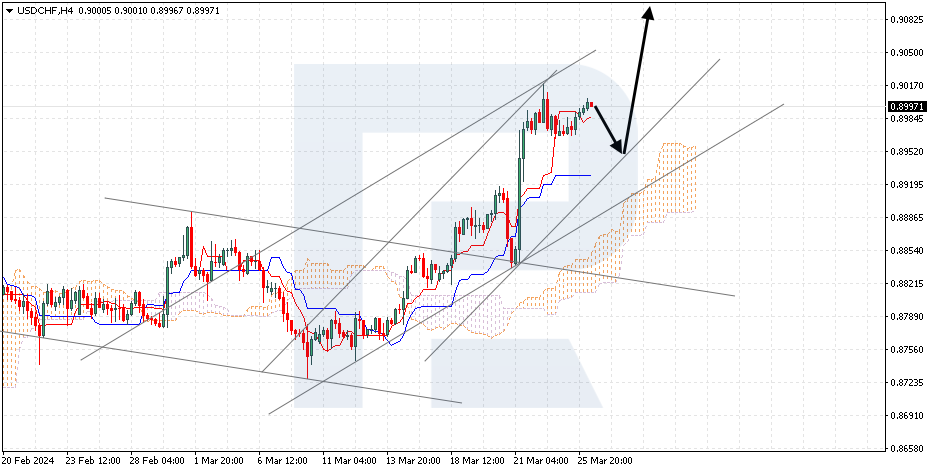

USDCHF, “US Dollar vs Swiss Franc”

USDHCF has established itself above the signal lines of the indicator. The instrument is going above the Ichimoku Cloud, which suggests an uptrend. A test of the Kijun-Sen line at 0.8950 is expected, followed by a rise to 0.9105. An additional signal confirming the rise will be a rebound from the lower boundary of the bullish channel. The scenario can be cancelled by a breakout of the lower boundary of the Cloud with the price securing under 0.8810, which will mean a further decline to 0.8715.

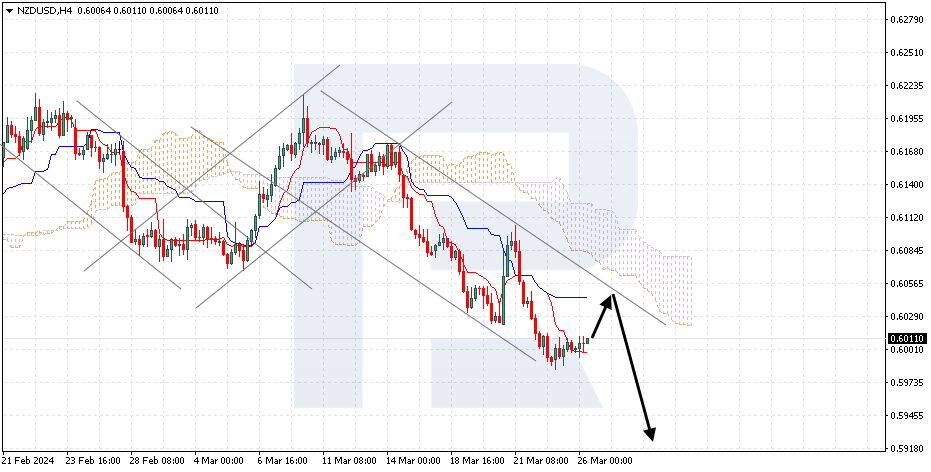

NZDUSD, “New Zealand Dollar vs US Dollar”

NZDUSD is correcting after a decline. The instrument is going below the Ichimoku Cloud, which suggests a downtrend. A test of the Tenkan-Sen line at 0.6040 is expected, followed by a decline to 0.5920. An additional signal confirming the decline will be a rebound from the upper boundary of the bearish channel. The scenario can be cancelled by a breakout of the upper boundary of the Cloud with the price securing above 0.6125, which will mean further growth to 0.6215.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.